Continuous challenges

During the ongoing COVID-19 pandemic, both small and large businesses have been faced with several challenges, whether that be adapting to remote working, cutting costs or managing cash flow.

Recent Payment Practices and Performance Regulation [PPR] reports seem to show that large businesses face more challenges than just the above and are still struggling to pay their suppliers on time. In a previous blog, where we looked at the payment culture at the start of the lockdown period and how businesses adapted to change, we concluded that large businesses have never been heroes when it comes to supplier payments, so the continuous problem comes as no surprise really. However, what does come as a surprise is that large businesses are now struggling to even report their last period on time.

The PPR was a law introduced back in April 2017, requiring large organisations to report on their payment practices every 6 months. Large organisations are considered to be those that exceed two of the following three thresholds: £36m annual turnover, £18m balance sheet total, or 250 employees. Each organisation is required to report within one month for each six-month period following its year-end.

Seems relatively simple right?

…sadly, this doesn’t seem to be the case for some large companies.

Late payments and now late reporters

The late payment culture in large organisations has been a continuous problem for some time now and there have certainly been no improvements during the last 6 months. In my last PPR blog, where I looked at the start of the lockdown period of March to July 2020, 26.6% of invoices were paid late and outside of agreed terms. This figure has only gotten worse since.

From analysing the period between August 2020 and February 2021, late payments have continued to worsen, with an average of 30.3% of invoices being paid late and the average longest standard payment period remaining at a shocking 71 days.

Not only have late payments got considerably worse, but there have also been several late reporters. This of course is better than those that did not report the period at all, but can we really blame them? It’s not as if the government are punishing those companies that fail to report (as far as we, and clearly the reporters, are aware).

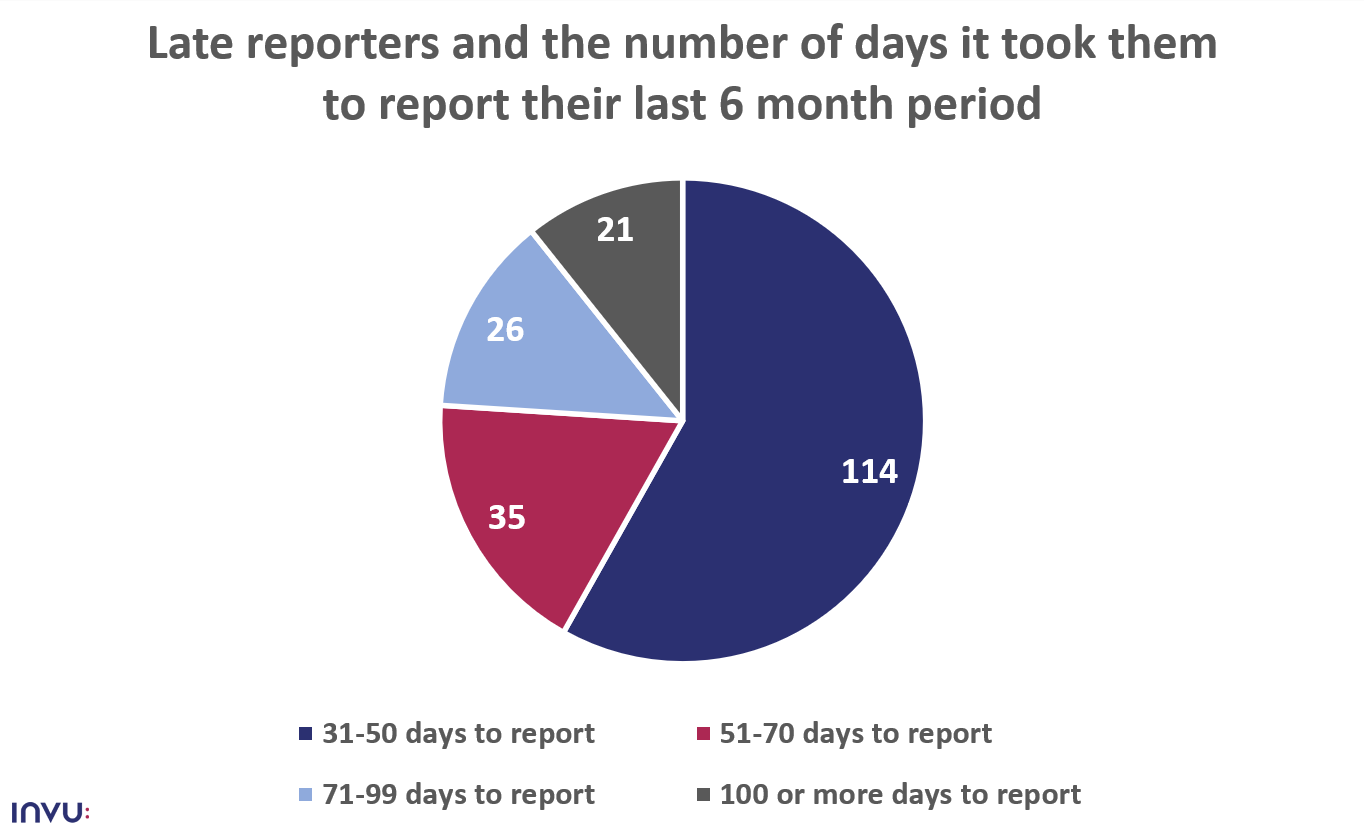

Of the 1533 reports that were analysed during the period, 196 of those companies took 31 days or longer to report their 6-month period. Clearly, there must be a problem here, as some large companies managed to report their period in less than 10 days.

A closer look into the late reporters

The chart takes a closer look at the late reporters and how many days they took to report. A shocking 21 companies took more than 100 days to report. These included well-known businesses like Fujifilm, who reported the period from April 2020 – September 2020 over 3 months late in January 2021, and the University of Winchester, who took 111 days to report the period from February 2020 – July 2020.

But the one question on our minds is: are the late reports and late payments due to the relevant staff being furloughed and not working due to COVID-19 and in turn struggling to gather the data and pay their suppliers? Or is it that a lot of large companies still do not have the right processes in place to be able to make timely payments? You would think that the need to adapt to new working conditions would prompt businesses to review their current processes and make improvements where necessary, but this does not seem to be the case.

Businesses must have the right people, processes and systems in place in order to pay suppliers on time, or even know where an invoice is at in the process. Businesses who still have a paper-driven and manual invoice process with complex approval processes may find it difficult to even get invoices approved and thus paid when working from home, not to mention even losing an invoice completely or making duplicate payments.

How can businesses improve?

Accounts Payable automation is an easy way to allow you to process invoices more efficiently whilst remaining fully in control of your finances, resulting in more timely payments to suppliers.

Systems like Verify automatically capture the relevant data from a digital copy of an invoice, routes it to the correct staff members electronically for coding and approval, and then automatically posts the data to the ERP system, ready for payment. Such systems allow you to set up your own approval routes and easily amend them when certain staff members are off sick to ensure all invoices can still get approved and paid with no disruption.

With access to a full audit trail, you always have full visibility of where an invoice is at in the authorisation process and who needs to action it. Duplicate and potential duplicate warnings also ensure that you never pay the same invoice twice.

A system like this ensures you know exactly where each invoice is, when it is due to be paid, and it will help you keep on track of what you owe suppliers. This helps make PPR reporting easy.